The Housing Market Information Portal (HMIP) is hosted by Nigeria Mortgage Refinance Company (NMRC). HMIP is the Nigeria housing and mortgage market place for buyers and sellers of real estate.

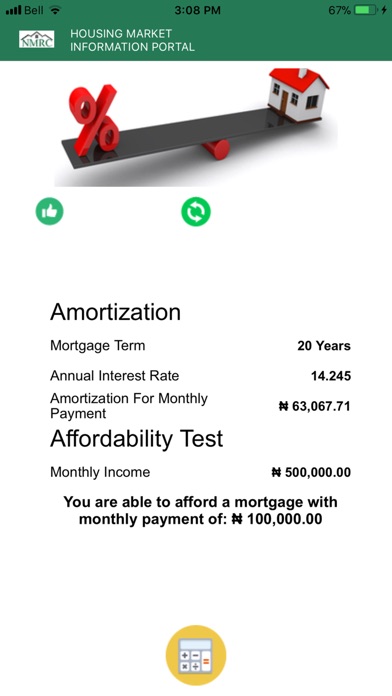

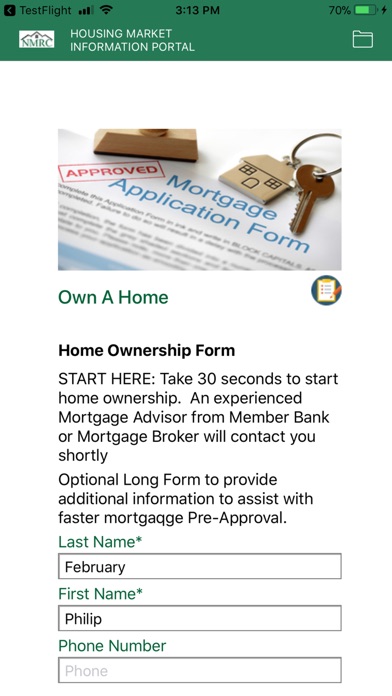

HMIP is a great source for mortgage information; mortgage rate and calculator, and connects mortgage professional advisors with potential home buyers. Home buyers could have all their questions answered and get pre-qualified for mortgage. Knowing how much you can afford to buy before committing time and energy in search your new home within your budget.

HMIP also provides Nigeria housing statistics and will be the central posting board for home sellers of real estate.

NMRC is a Public Private Partnership between the Federal Government of Nigeria and the private sector. It was implemented as a component of the Nigeria Housing Finance Programme initiated by the Federal Ministry of Finance (“FMoF”) in collaboration with the Central Bank of Nigeria (“CBN”), Federal Ministry of Lands, Housing & Urban Development (“FMLHUD”) and the World Bank/International Finance Corporation (“IFC”).

NMRC is a private sector driven company with the public purpose of developing the primary and secondary mortgage markets by raising long-term funds from the capital market and thereby providing access to affordable housing finance in Nigeria.

NMRC was incorporated on 24th June 2013 and obtained its final license to operate as a non-deposit taking financial institution from the CBN on 18th February 2015. The institution is regulated by the CBN under the Regulatory and Supervisory Framework for the operations of a Mortgage Refinance Company.

Vision & Mission Statements:

NMRC’s vision is to be the dominant housing partner in Nigeria. Its mission is to remove barriers to home ownership, provide liquidity, affordability, accessibility and stability to the housing market in Nigeria. Business Objectives

• To encourage financial institutions to increase their mortgage lending by providing them with long term funding;

• To increase the maturity structure of mortgage loans and assist to reduce mortgage rates;

• To increase the efficiency of mortgage lending by taking a lead role in proposing changes to the enabling environment for mortgage lending as well as by

standardising mortgage lending practices of financial institutions; and

• To introduce a new class of high quality long-term assets to the pension funds and other investors.